Welcome to Money Buff! Feel free to check out my other posts, and follow me on Twitter for more regular thoughts! For more about the hows and whys of investing, subscribe here:

A few years ago, the Harvard Business Review published an article titled '“The Female Economy”. It found that women make the majority of purchase decisions in households (I don’t think we needed Harvard to tell us this). The main takeaway was that it would be foolish to ignore or underestimate the female consumer.

From this, the Becky portfolio was born. It’s made up of lifestyle brands that sell premium products to affluent women.

Whether we like it or not, Becky is thriving. It only makes sense that an investment in her lifestyle would do the same. Companies you might see in a typical Becky portfolio include:

Starbucks ($SBUX)

Lululemon ($LULU)

Estee Lauder ($EL)

Etsy ($ETSY)

Williams Sonoma ($WSM)

Ulta Beauty ($ULTA)

Moët Hennessy Louis Vuitton ($LVMUY)

It seems obvious - track the spending habits of women. But could it actually make money? A variation of the Becky ETF, although no longer tracked, had an outstanding run in the market — outperforming the S&P 500 by 995%.

Before you YOLO your next paycheck into this strategy, remember this is a small sample size. Obviously, it’s not foolproof but it begs the question of how strongly public perception influences the performance of a company.

Warren Buffett made his billions buying into American consumerism. One of his pieces of advice is to invest in companies with a sustainable economic moat, a term that usually refers to companies with strong brands.

High inflation has put consumer companies under pressure while rising interest rates have led to a decline in tech company valuations.

In a world of rising costs, Buffet’s view is more true than ever. Strong brands have pricing power. In other words, they can raise prices without substantially affecting demand.

The problem is that it’s difficult to measure pricing power. If Apple raises the price of iPhones by $50, how can we predict if demand will remain consistent? We can’t. But we can use brand value to loosely identify pricing power.

In 1988, Interbrand developed a proprietary method for estimating the intrinsic value of a brand name. It relies on measuring future company earnings due to brand, instead of other characteristics like product quality.

Researchers tested a strategy investing in the 100 most valuable brands annually. Here are the top 15. Recognize any?

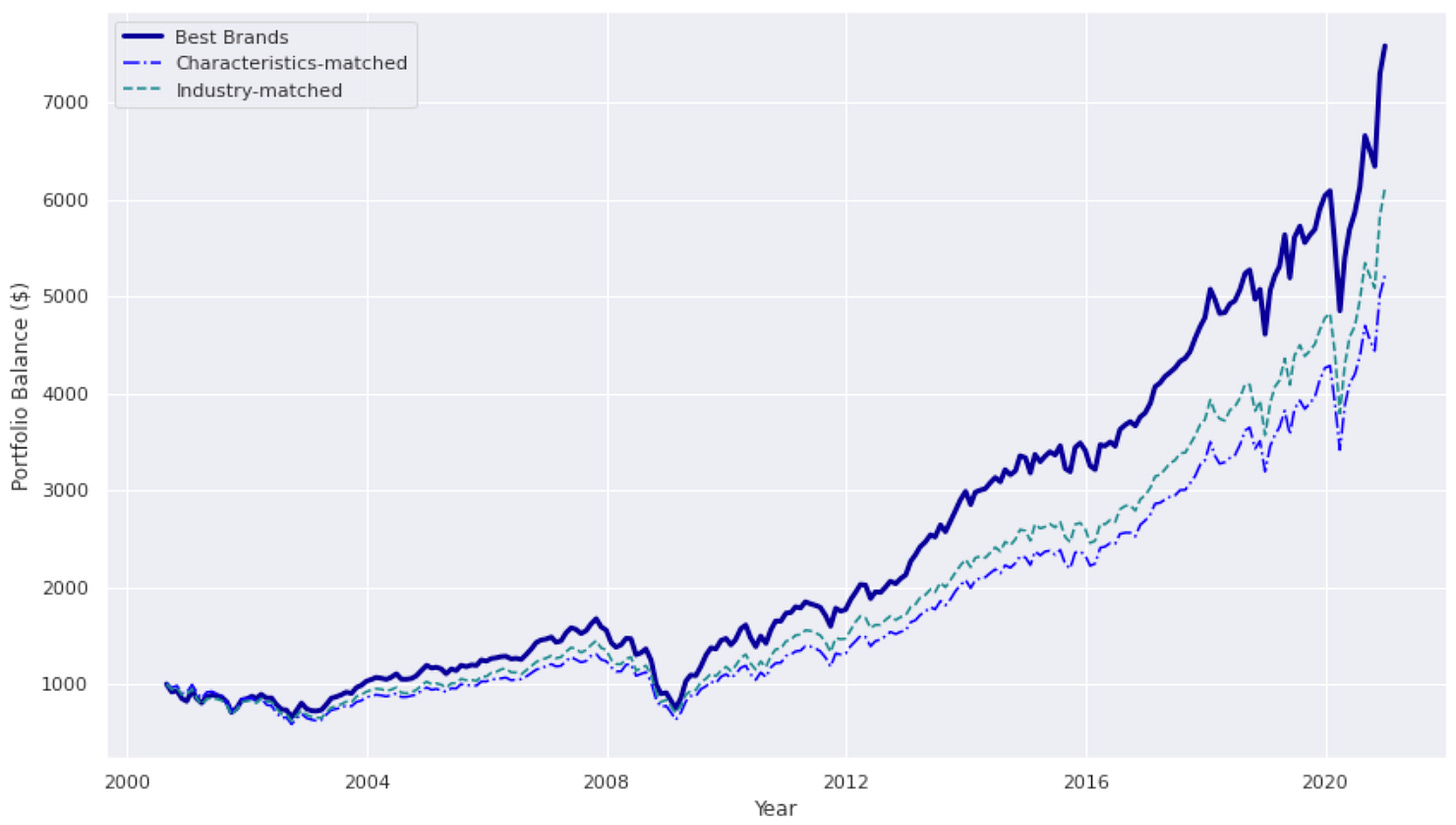

They compared the performance of this portfolio to the same investment in two benchmarks: characteristics-matched and industry-matched. Below is the hypothetical growth of $1000 in each portfolio. The best brands portfolio earns an excess return of ~3% to 4% per year.

This may not be surprising since powerful brands drive stakeholder preference, ultimately increasing shareholder value. But what is surprising is that the outperformance of the best brands comes from an underestimation of just how good they are.

We can forecast the upcoming earnings of Apple using product sales. That’s fairly straightforward. But accounting for the future benefits of the brand name is much more complex. Such a high-value brand could successfully launch a whole new product (ex. Apple Car, VR headset), making it harder to forecast future earnings growth.

If the market underestimates future earnings potential, these companies earn long-term excess returns. This ability to consistently exceed expectations is what drives the outperformance of the best brands.

The CFO of LVHM Jean-Jacques Guiony said it best on a recent earnings call:

“The reality is that pricing power is actually a function of the desirability of the brand. Desirable brands can increase prices and non-desirable brands cannot. It’s as simple as that. So what it is about is really developing strategies, marketing, products, distribution strategies that will increase desirability of the brand, so that in tough times or in other times, we can reflect into prices the cost of doing business. It’s as simple as that.”

The ‘tough times’ part is key. The findings of the best brands experiment were also consistent with the fact that strong brands do well in both good times and bad. This becomes particularly relevant as we enter another recession.

Brand value can rise or fall for countless reasons. And it's worth looking at for the companies you’re invested in, or want to invest in. Note how their brand value changes over time.

Banks took huge hits in brand value when the public lost trust in them during the Great Recession. Their brand value fell off a cliff around the time of the crisis. 14 years later, Citigroup’s brand value is still recovering. It’s no coincidence that the share price follows suit.

Apple has enjoyed enormous success since the 2010s. Last week, it was named Interbrand’s most valuable brand for the tenth year in a row. Again we see the brand’s value increasing in near lockstep with the share price.

Companies like Apple transcend their market and can command a premium over the competition. Its enterprise value reflects not only customer loyalty but the expected premium over competitors.

Intuitively, we know that companies with powerful brands will control economic moats that can consistently generate high returns on invested capital. But research shows that the stock market does not always fully incorporate the long-term impact of this intangible asset. It’s not something you can find on a balance sheet.

Strong, enduring brand capital is a competitive advantage. Investing in these brands can be a way to limit downside in a time of many downsides.

They say alcohol stocks are good investments because whether the economy is good or bad, people will drink. Whether or not that’s true, the logic applies to brand value. We know that regardless of economic conditions, Becky is getting her mocha latte.

- Sam

Super interesting!

Never heard of the Becky ETF before & I think the logic behind it is brilliant.